November saw broad positive performance across all asset classes. Markets responded favorably to election outcomes, with equity markets reaching new all-time highs and small cap companies seeing the most impressive returns.

“Although widely debated, the actual impact of tariffs remains complex and uncertain, potentially being less inflationary than some market expectations and commentators suggest.”

In November, the Personal Consumption Expenditures (PCE) report indicated continued stability in inflation metrics. Both Headline and Core PCE remained relatively steady year-over-year, with Headline PCE increasing from 2.10% to 2.31%. Core PCE increased slightly from 2.65% to 2.80%. While month to month inflation can be bumpy the overall trajectory toward the Federal Reserve’s 2% target remains intact, albeit at a slow pace.

Concerns about a resurgence in inflation persist, with many pointing to the new administration’s policy proposals as a potential factor. This is reflected in the fixed income markets, where the 10-Year Treasury yield surged leading up to and following the election, though it has moderated slightly in the latter half of November. Among the proposals, tariffs remain a focal point, with mentions of 20% tariffs on all imported goods, 25% tariffs on goods from Canada and Mexico, an additional 10% tariffs on goods from China.[1], [2]

Tariffs, essentially a tax on imports, are designed to protect domestic industries and jobs by increasing the cost of imported goods. Their broader economic effects, however, are far more intricate. Beyond the potential for higher consumer prices and short-term inflationary pressures, tariffs often trigger retaliatory measures from trading partners. Retaliatory tariffs are a common response, and history provides clear examples. The European Union and China, in reaction to previous U.S. tariffs, imposed taxes on key American exports such as bourbon, soybeans, and motorcycles. These measures disrupted U.S. industries reliant on exports, notably agriculture, where retaliatory tariffs resulted in significant employment and income losses. In addition, retaliatory actions often exacerbate trade imbalances. For instance, trading partners might reroute imports, bypassing U.S. suppliers altogether. This diversion reduces demand for American goods, potentially pressuring GDP and affecting domestic industries reliant on global supply chains. The reduced foreign demand for U.S. goods coupled with dampened domestic business activity introduce deflationary forces.

Even if tariffs lead to price increases for certain goods, they may not result in widespread inflation.

Job losses in certain affected industries and reduced demand in other industries as a result of lower consumer demand can introduce additional offsetting deflationary impacts. This, coupled with a stronger U.S. dollar—up roughly 5% since September—could mitigate the costs of tariffs by offsetting some price increases. Additionally, It remains unclear whether the administration’s rhetoric will align with its actions – blanket tariffs may be unlikely; they will most likely serve as negotiating tools or targeted measures for specific industries.

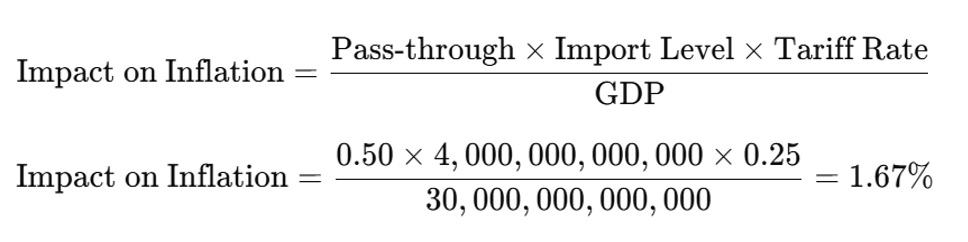

To approximate the potential one-time price increase from a proposed tariff, we can use the below calculation using a hypothetical blended tariff rate of 25% on all imported goods, an import level of roughly 4 Trillion [3], a conservative tariff pass-through rate estimate of 50% (meaning approximately 50% of the increased cost from the tariff will be passed on to consumers), and a GDP estimate of 30 Trillion [4]. Without considering offsetting inflationary effects, as shown below, the outcome being a one time increase of only 1.67% before accounting for any offsetting effects:

Although widely debated, the actual impact of tariffs remains complex and uncertain, potentially being less inflationary than some market expectations and commentators suggest.

Looking ahead to the Federal Reserve, their final FOMC meeting of 2024 will take place on December 18th and will be accompanied by the Summary of Economic Projections (SEP), released only four times a year. The SEP provides valuable insights into expectations for rate cuts, inflation, unemployment, and GDP. Currently, the market is pricing in a 25-basis point rate cut at that meeting and two additional 25-basis point cuts in 2025. However, if the SEP signals additional rate cuts, markets may recalibrate their expectations to align more closely with the Fed’s projections, potentially impacting bond yields and interest rates.

1. https://truthsocial.com/@realDonaldTrump/posts/113546215051155542

3. https://www.bea.gov/data/intl-trade-investment/international-trade-goods-and-services

Download The Full Market Update

~Diligently Yours,

Your Smarter Way Portfolio Management Team

Please note this is for information purposes only and should not be construed as investment advice or recommendations made by A Smarter Way to Invest. Please contact your Advisor if you have any questions about this market update report or if you would like to discuss your personal financial situation in more detail.