August was marked by heightened market volatility, driven by a series of economic surprises and geopolitical concerns, and intensifying recession fears as evidenced by a flight to safety in bonds and corresponding dip in yields. Yet, by the end of the month, markets staged an impressive recovery, with the S&P 500 nearly hitting new all-time highs.

“With the resilience demonstrated this month by U.S. equities as well as the normalization of treasury yields in the long-end of the yield curve, a move by the Fed to cut short-term rates later this month offers a case for cautious optimism that a path to a soft landing may still be possible.”

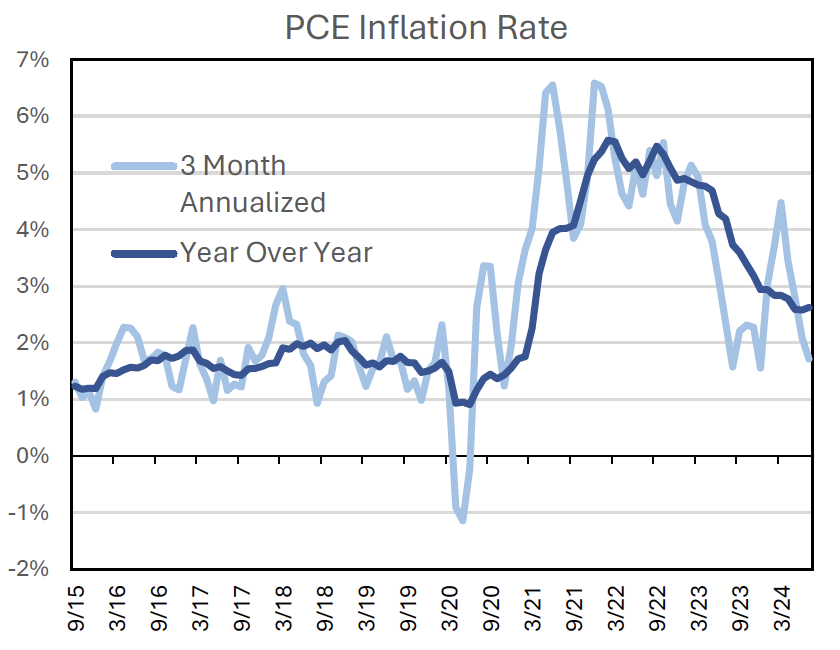

In August, the Personal Consumption Expenditures (PCE) report continued to show stability in inflation metrics, maintaining last month’s trend. Both Headline PCE and Core PCE remained relatively steady in year-over-year price growth, with Headline PCE rising slightly from 2.47% to 2.50% and Core PCE increasing marginally from 2.58% to 2.62%. Similarly to last month, the month-over-month change in Core PCE shows further encouraging signs, coming in at just 0.161%. As has been mentioned before, month-tomonth data can be volatile, and thus we turn to the threemonth annualized figure to gain a clearer picture of the current trend. The three-month Core PCE inflation rate shows an annualized rate of 1.72%, below the Fed’s 2.00% target, and suggesting that we are on a path to reaching the Fed’s target, and ultimately indicative that rate cuts could be on the horizon.

Despite positive inflation data, equity markets began August on shaky ground, with a steep sell-off in the first few days. This abrupt shift in market dynamics stemmed from weak US jobs data and a rise in unemployment announced early in the month, combined with disappointing earnings from major tech companies like Intel and Amazon rekindling concerns of an impending recession and shaking investor confidence. By the end of the first week, the S&P 500 had plunged 6.1%, the NASDAQ fell by nearly 8%, and the Russell 2000 sank 9.5%. To add to the turbulence in U.S. and international equity markets was the unwinding of the yen carry trade, triggered by Bank of Japan’s decision to raise its policy rates for the first time in years. The Nikkei 225 plummeted nearly 20% in just three days, as investors scrambled to close out their positions in the Yen currency, driving a massive flight of capital out of both U.S. and Japanese equities.

These developments fueled rampant speculation that the Federal Reserve might cut rates by 50 basis points at its upcoming September meeting, with some market participants even advocating for an emergency intermeeting rate cut. After hitting all-time highs in July, the S&P 500 experienced a decline of over 8% mid-August before managing to recover most of its losses by the month’s end.

The turbulence in U.S. equity markets prompted investors to seek refuge in fixed income, with the flight to longer-term treasuries driving yields lower, and resulting in the 10-year – 2-year treasury yield spread turning positive for the first time in nearly 2 years. By the end of the month, however, U.S. equity markets managed to climb their way back to an impressive recovery, buoyed by softer-than-expected inflation data and an improvement in economic reports later in the month.

Looking ahead, market expectations for rate cuts have since moderated. Most investors now anticipate a more measured 25-basis point reduction at the Federal Open Market Committee’s (FOMC) September 18th meeting, compared to earlier forecasts for a more aggressive 50-basis point cut. As the data continues to evolve, the trajectory of monetary policy will likely depend on whether inflation remains subdued, and the broader economy shows signs of stabilization. With the resilience demonstrated this month by U.S. equities as well as the normalization of treasury yields in the long-end of the yield curve, a move by the Fed to cut short-term rates later this month offers a case for cautious optimism that a path to a soft landing may still be possible.

Download The Full Market Update

~Diligently Yours,

Your Smarter Way Portfolio Management Team

Please note this is for information purposes only and should not be construed as investment advice or recommendations made by A Smarter Way to Invest. Please contact your Advisor if you have any questions about this market update report or if you would like to discuss your personal financial situation in more detail.